25 March 2020

Covid-19: how have sell-side analysts reacted so far?

Given how fast the market dropped, it is a fair question: have sell-side analysts already reviewed the prospects and target price of companies they are in charge of or are they still assessing the situation?

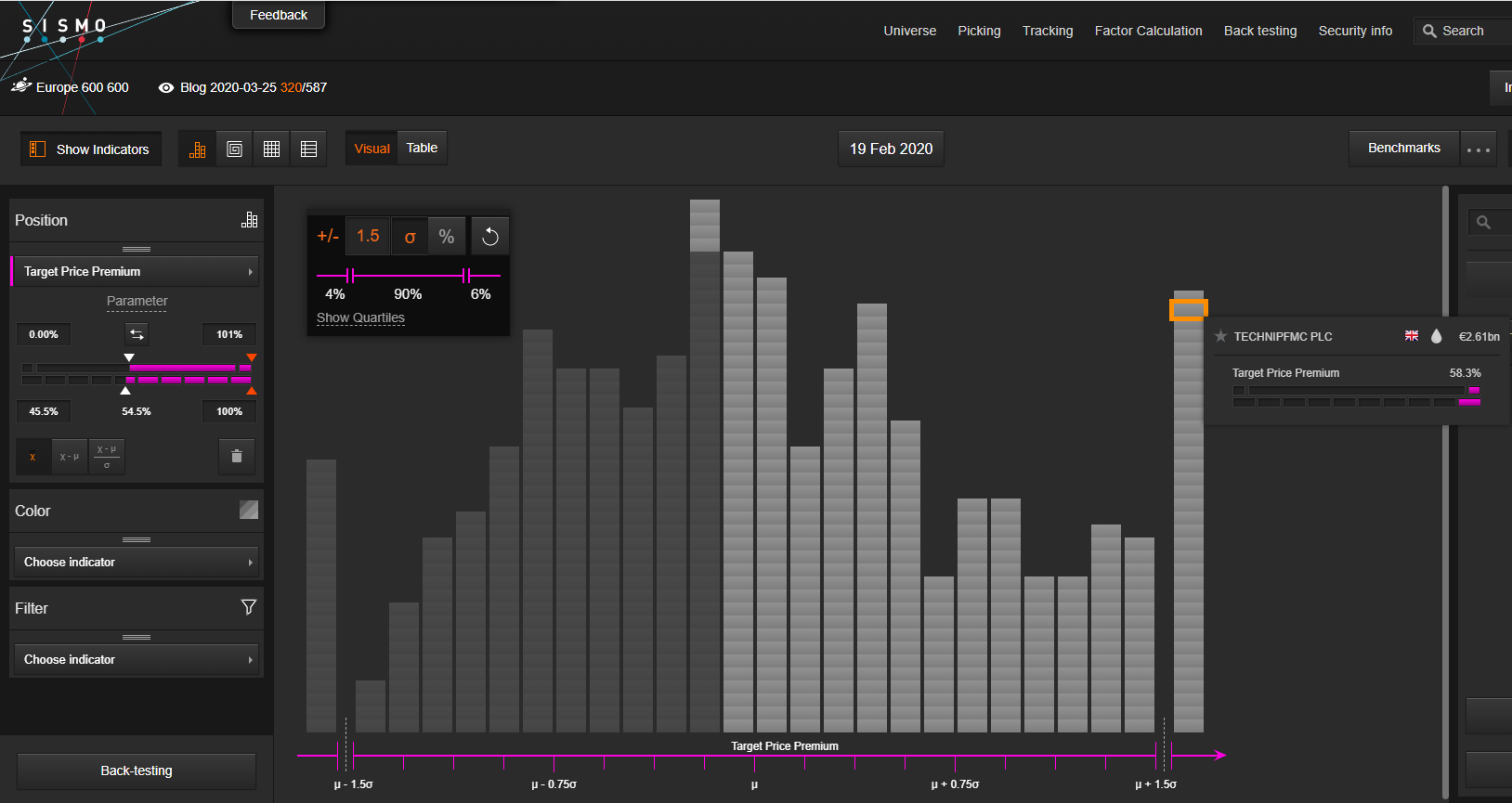

We look at the distribution of target price premiums (TPP) in a large European universe right at the top of the market on 19 Feb. 2020. Target Price Premium is defined as , where TP is the target price from sell-side consensus extracted from S&P Capital IQ database). Each tile represents a stock and TPPs are distributed from left to right: stocks with large (resp. low) TPP stand on the right (resp. left) side of the distribution. For example, according to sell-side consensus, Technip was undervalued by 58% as of 19th Feb.

Target Price Premium of Top 600 European Stocks as of 19th Feb. 2020

The shaded side of the distribution on the left corresponds to stocks with negative TPP. As can be roughly seen on the chart, there were more undervalued stocks compared to overvalued, showing the general optimism of sell-side analysts. Sismo gives a more precise estimate of 55% of stocks with positive TPP at the time.

Now we look at the same TPP distribution a month later, together with the corresponding total return of individual stocks over the period (red for negative returns, green for positive).

Target Price Premium (position) and Total Return (color) of Top 600 European Stocks as of 19th Mar. 2020

Not surprisingly, most of the stocks were in the red over the period and the shaded area dropped massively in size: a staggering 96% of stocks now benefit from a positive TPP, implying that analysts have not yet adjusted their forecasts, letting the free-falling price component distort their TPP expectations.

But have they really just been sitting on the sidelines? not that simple. Let’s take a closer look at target price revisions over the period 18 Feb. – 19 Mar. Revisions are distributed from left (negative) to right (positive). Greyed out area corresponds to companies with positive TP revision. White circled are stocks from the Oil & Gas sector.

1 month Target Price revision of Top 600 European Stocks over the period 18 Feb. – 19 Mar.

Fueled by dire economic forecasts, sell-side analysts slashed 75% of their target prices, with Oil & Gas stocks taking a large share of the downgrades.

Overall, the median change in TP was a mere -2%, compared to a median total return of -33% over the period, which explains why most stocks now exhibit very high TPP, as described in previous section.

Among the largest upgrades, Delivery Hero and Hellofresh (food box delivery) have been benefiting from the current lockdown.

To conclude, analysts seem to be running way behind the brutal market action and it will certainly take a lot time before they come back in sync.

2,420 total views, 1 views today