11 May 2020

Hedge Funds Stock Picking Darlings: High-Quality Stocks at the Risk of Overcrowding: Where to Find Alternatives? (Part II)

See important disclaimer at the end of the page

This article is a follow-up of this post where we analyzed the performance and factor profile of the so-called “hedge-funds Hot-Dogs”. Fueled by sell-side optimism, investors have been piling up their holdings of these stocks, at risk of overcrowding.

In this post, we will explain how investment professionals can find stocks that are similar to Hot-Dogs – but in a somewhat less crowded market environment – using Sismo’s factor peer search.

Hunting for alternatives to Hot-Dogs: introducing Sismo Factor Peer Search

A portfolio manager holding Hedge-Funds Hot-Dogs might therefore want to look for alternative stocks with similar characteristics, yet less exposed to such reversal risk. The Sismo Peer Search is a convenient tool to achieve this.

Starting with any original stock, users can look up stocks with comparable Factor profiles, within the same industry/sector or in the whole universe.

In addition, it is also possible to access comparable stocks on all but one factor, in order to tilt portfolio exposure toward or away from such factor.

Use cases for Sismo Peer Search include:

- Uncover stocks with similar profile to favorite positions (“If you liked the first one, don’t let this one slip away!”)

- Look for similar yet smaller stocks that can claim future leading positions in their industry

- Find correlated short positions vs. long holdings (for hedging or pair-trading purposes)

In our example, the investment manager can use this functionality to keep a general exposure similar to that of the Hedge-Funds Hot-Dogs (on Quality, Growth, etc.) while avoiding stocks prone to excess optimism/overcrowding.

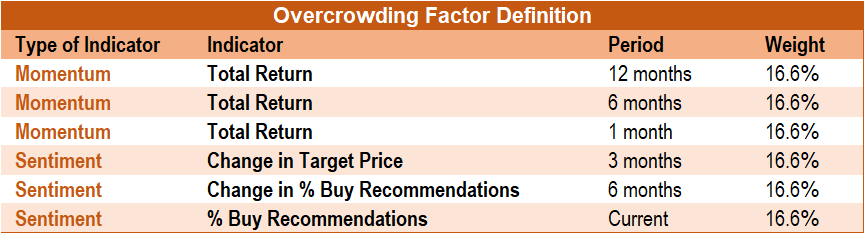

To that end, we define an Overcrowding Factor as a combination of Momentum and Sentiment indicators:

After we added this new factor to other common factors (such as Value, Risk, etc.), we run Sismo Peer Search for certain stocks in the Hedge-Funds Hot-Dogs list and display the profile of a comparable company that the Sismo search engine found in the same industry/sector.

We also provide the full list of primary alternatives for the Hedge-Funds Hot-Dogs list at the end of this article.

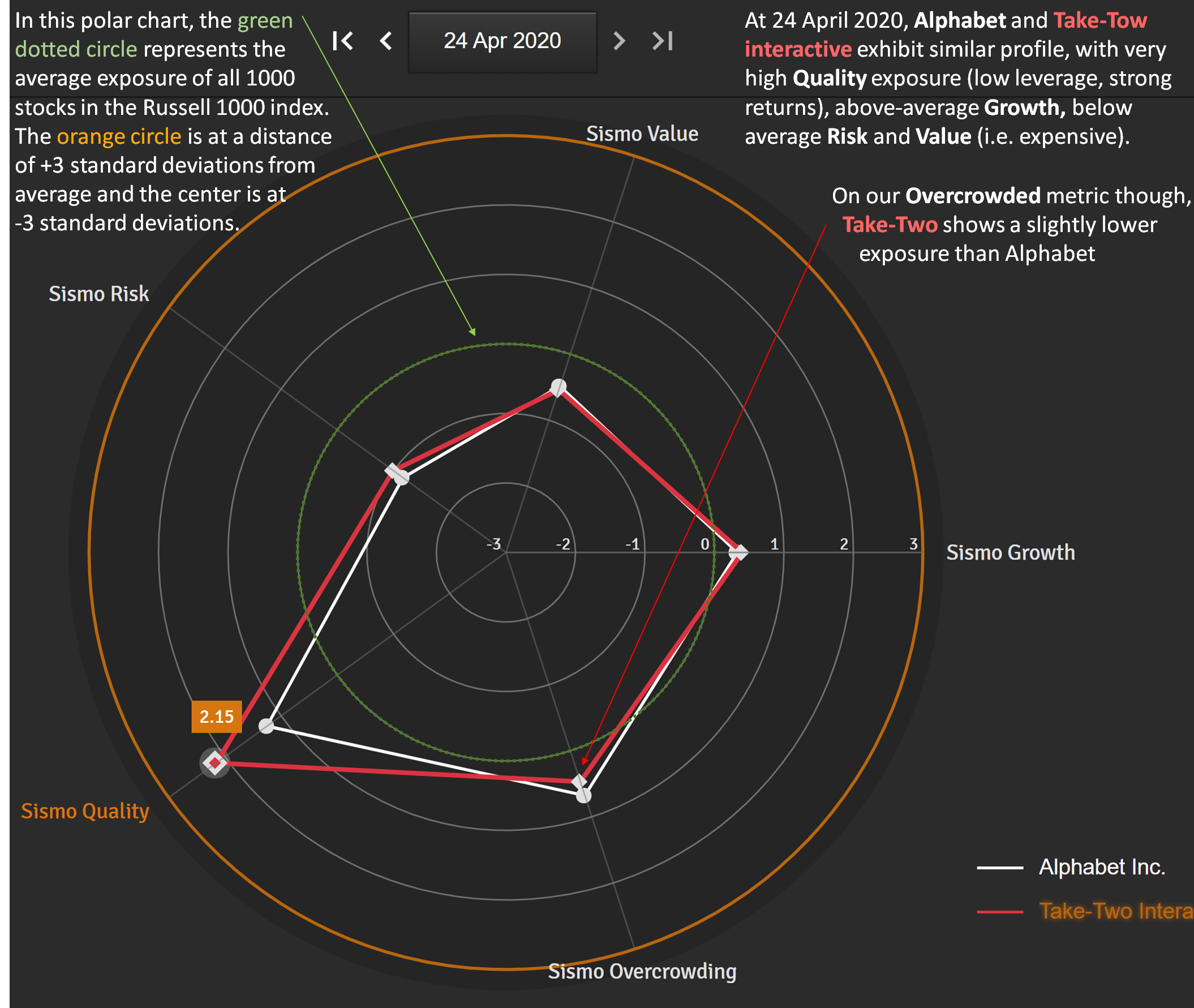

- Alphabet

It is not easy to find companies with metrics as good as Google in the tech industry and at the same time less popular.

Sismo found one notable exception with leading video games producer Take-Two Interactive.

TTI exhibits comparable Value and Growth exposure, better Quality, slightly lower Risk with less-than-half the Overcrowding risk of Google.

Compared Factor profile of Alphabet and Take-Two Interactive as of 24 Apr. 2020

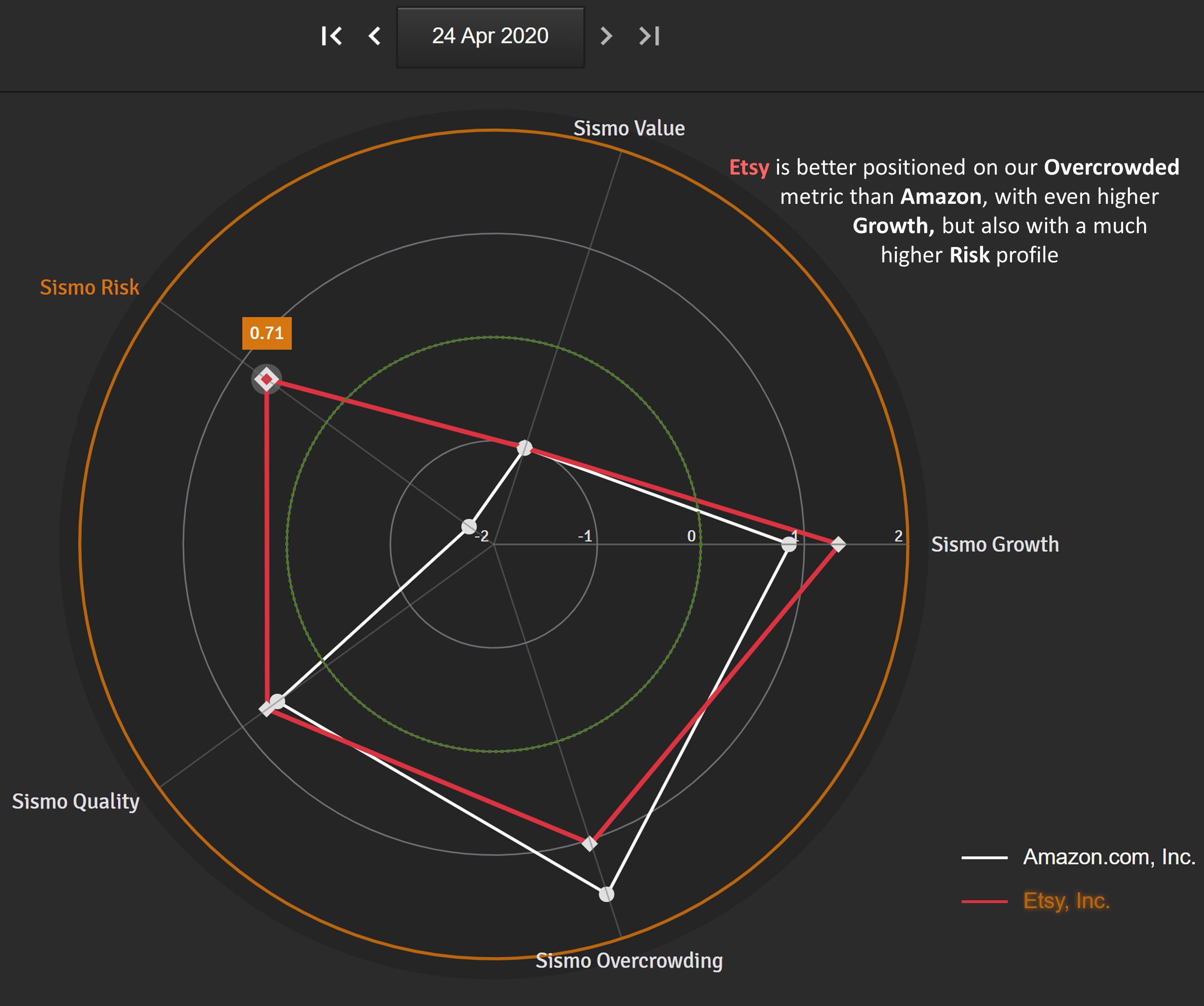

- Amazon

No one does as well as Amazon in its sector, as most traditional retailers are experiencing big declines in revenues.

Sismo pointed one less popular exception: Etsy, a small ($7bn market cap) profitable and quickly growing online retailer.

Unsurprisingly, the alternative comes at a much higher risk level…

Compared Factor profile of Amazon and Etsy as of 24 Apr. 2020

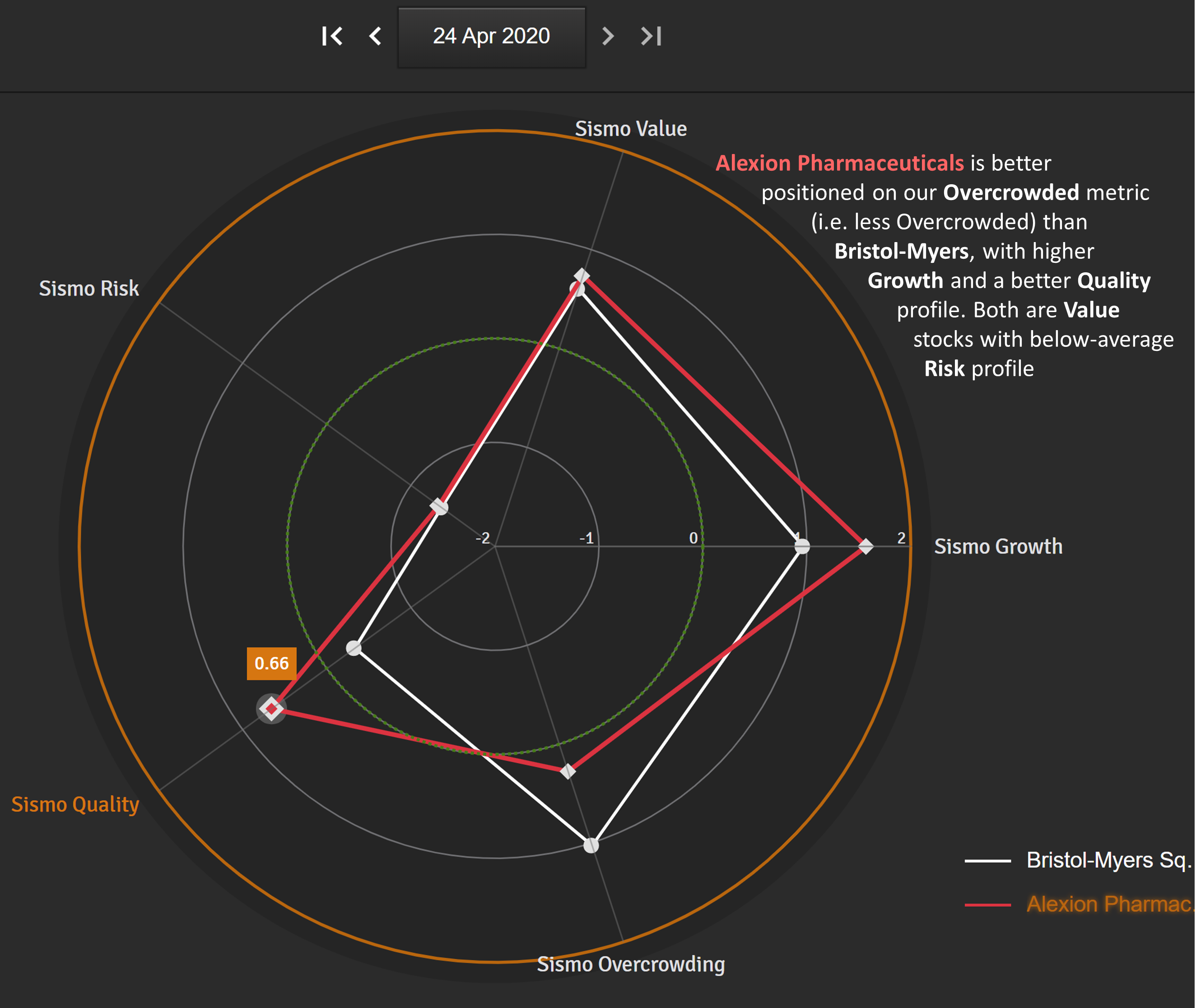

- Bristol-Myers

Biopharmaceutical company Alexion compares very favorably to its giant peer Bristol-Myers.

It shows superior Growth & Quality while maintaining similar Valuation levels and much lower Overcrowding risk.

Compared Factor profile of Bristol-Myers and Alexion Pharmaceuticals as of 24 Apr. 2020

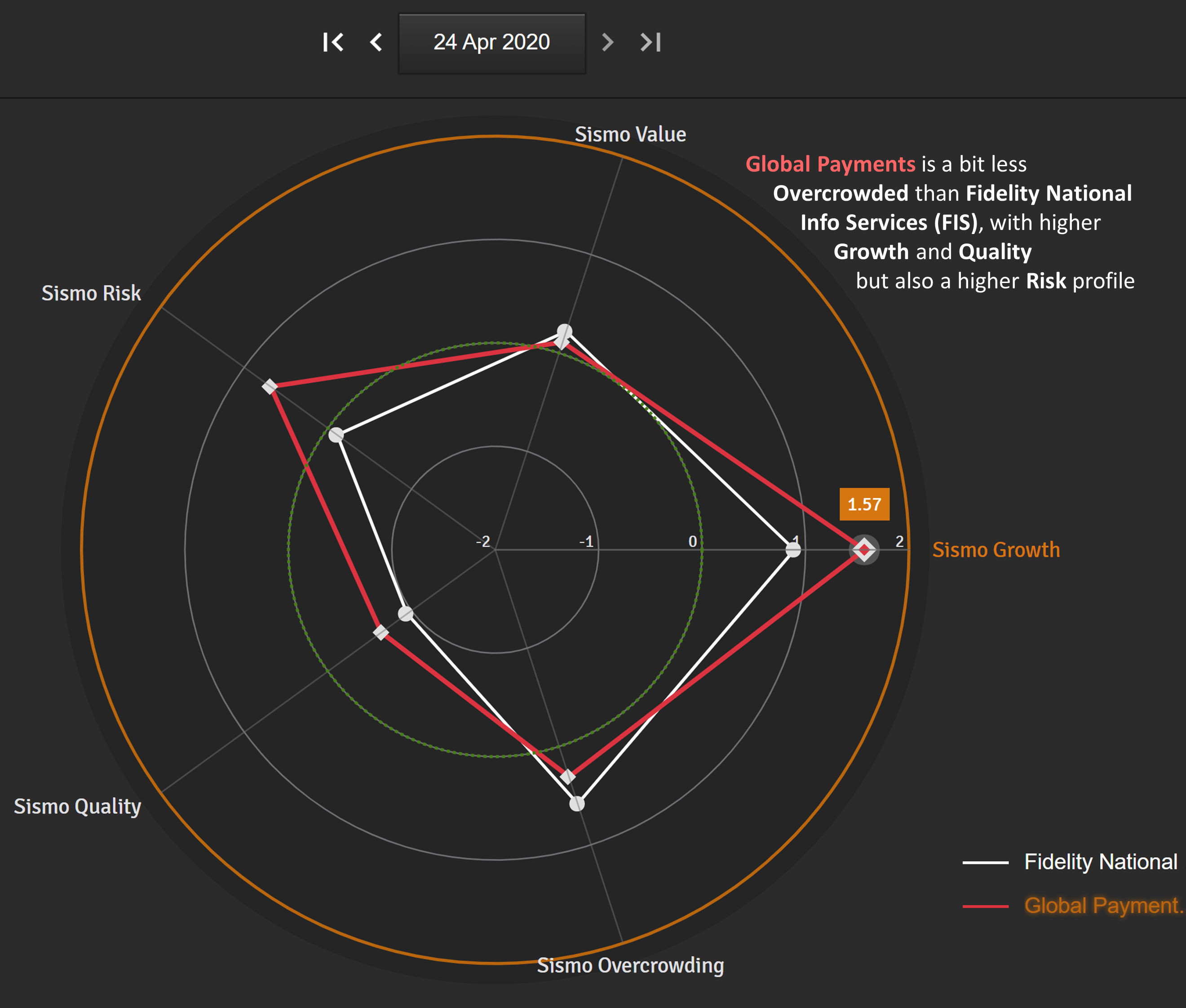

- Fidelity National Info Services

Fidelity National Information Services (FIS) is an international provider of financial services technology and outsourcing services.

Active in the same industry, Atlanta-based competitor Global Payments exhibits similar financial characteristics, with a bit more Risk and Growth but less Overcrowding risk than FIS.

Compared Factor profile of FIS and Global Payments as of 24 Apr. 2020

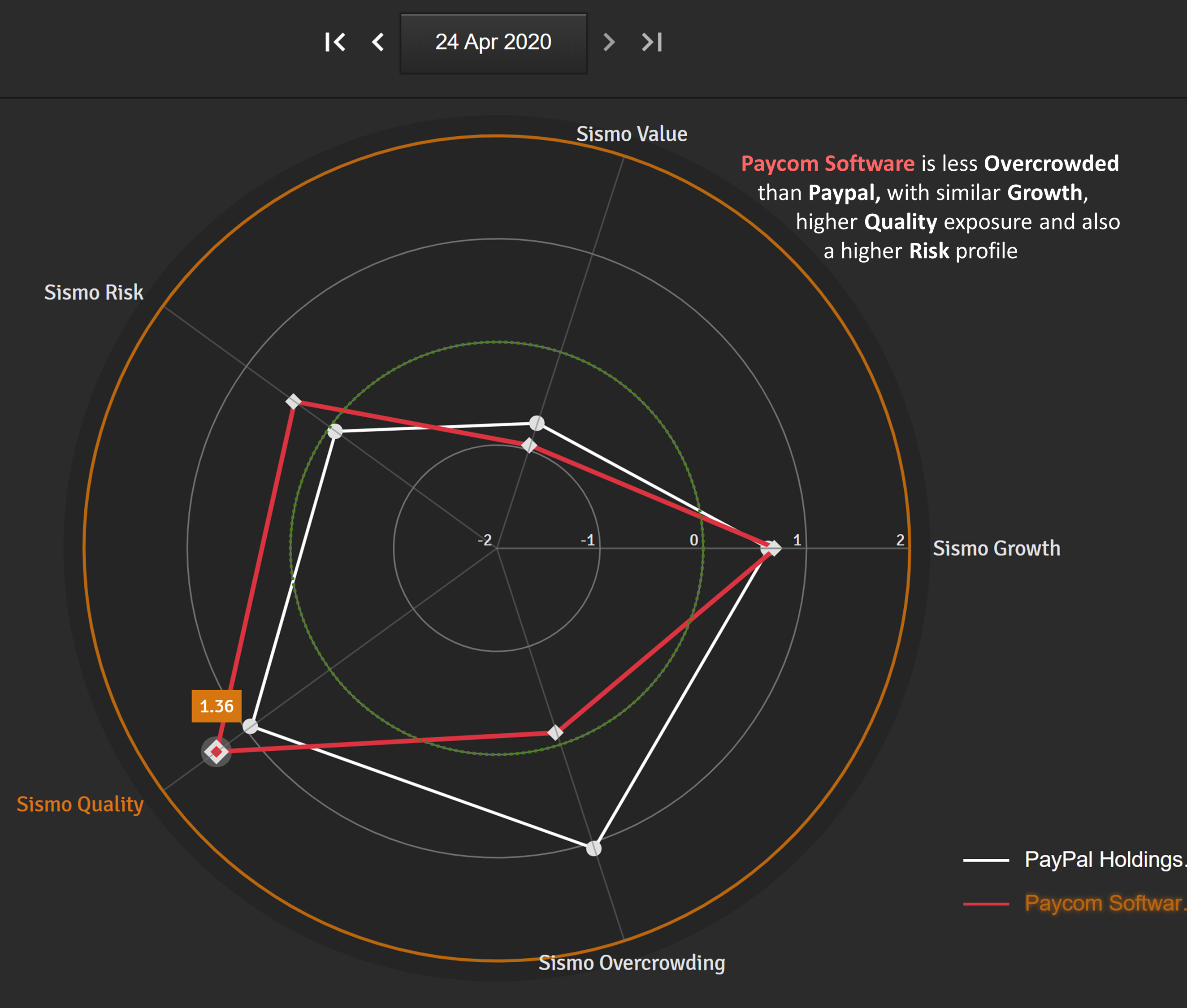

- PayPal

Final pick in this alternative list: Paycom Software which came up as Factor peer to PayPal.

Paycom Software offers online payroll services and HR software solutions for large and small businesses.

Based on its Factor exposures, Paycom is a profitable and fast growing company which does not show the overcrowded profile of PayPal.

Compared Factor profile of Paypal and Paycom as of 24 Apr. 2020

Conclusion

We provide below the full list of possible alternatives to Hot-Dogs stocks. This is illustrative as no research was engaged to assess the relevance of such alternatives from a fundamental perspective.

RBC Capital Markets Hedge-Funds Hot-Dogs List and Sismo Alternatives

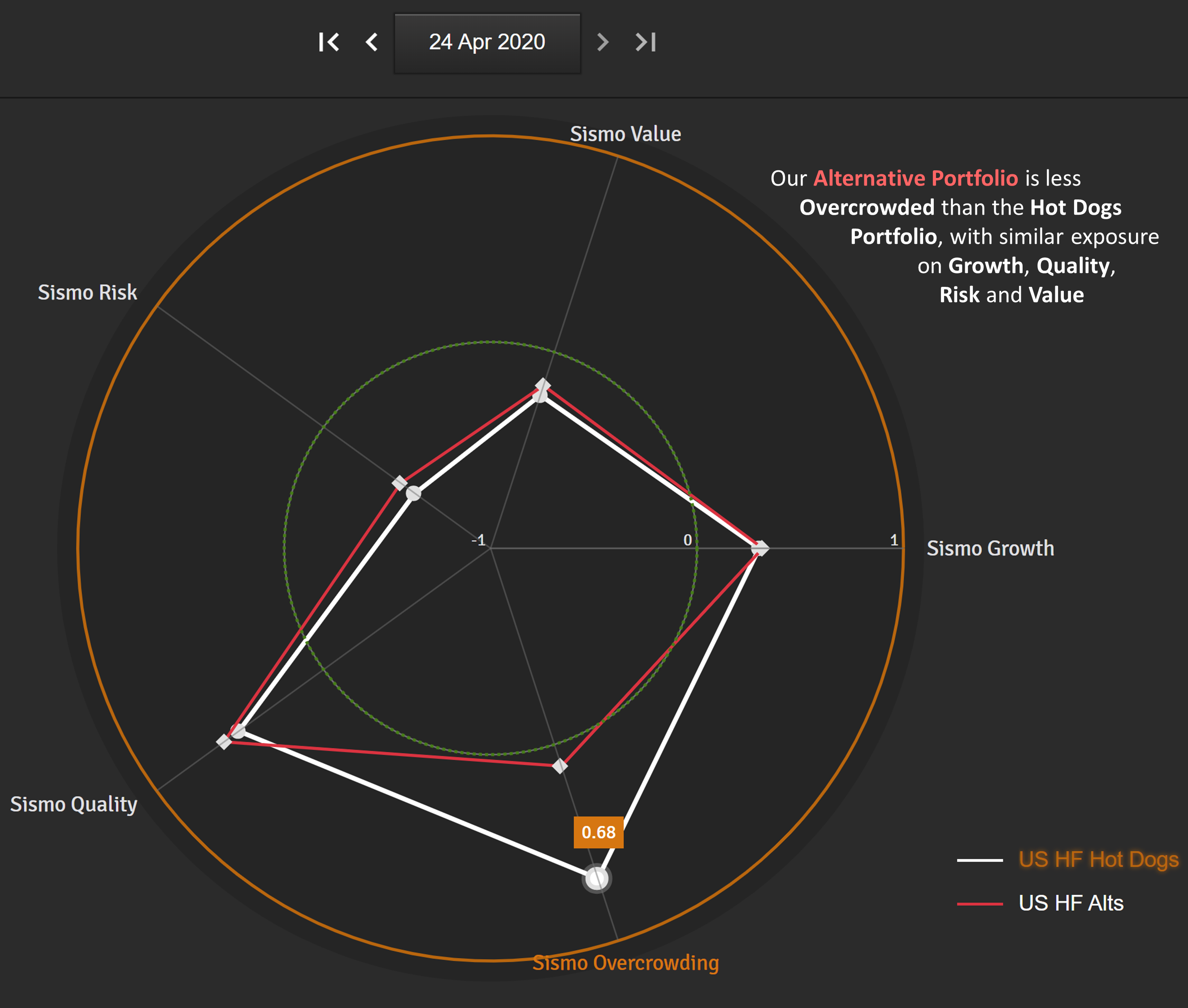

As expected, a comparison of the average Factor profile of the original list and its Sismo alternative shows high similarity on overall Factor exposures with significant reduction in Overcrowding risk.

Compared Average Factor profile of Hot-Dogs vs. Sismo Alternatives as of 24 Apr. 2020

About Sismo

If this note sparked some interest and made you think, we would love to hear your comments at contact@sismo.fr. This study on the US equity market illustrates the analysis and visualization capabilities of Sismo, a visual analytics platform with direct web-access designed for discretionary equity portfolio managers that is integrated with European and US equity coverage from S&P.

Sismo combines innovative visualizations with advanced user interactions to facilitate the reading and understanding of market dynamics, select stocks, define and test investment strategies. It offers innovative screening and back-testing functionalities as well as investment style recognition and marginal portfolio optimization, leveraging on visual analysis capabilities to improve professionals’ investment decisions. Please visit www.sismo.fr.

Disclaimer : Past performances are not indicative of future performances. The information in this article is provided for information only and does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell, or otherwise transact in any investment including any products or services or an invitation, offer or solicitation to engage in any investment activity.

3,414 total views, 5 views today