08 June 2020

Getting Better at Value Screening: A Quick Guide to Drawing Up Stock Lists

See important disclaimer at the end of this article

We start today a new series of articles which highlight how portfolio managers and analysts can take advantage of Sismo to identify stocks relevant to their own investment style and objectives. Our first use case illustrates how to build up a list of stocks matching user-defined Value style criteria.

The Case for Pete

Pete is a Value portfolio manager with a 20 year-experience in US large-cap equities (Russell 1000). Having left his last position, he has enjoyed garden leave on a deserted island, with no access to any source of information over the last six months (lucky fellow!). Back to business, he discovers with amazement – and after the fact – the Covid crisis, the lockdown, the financial crash and the no less surprising market recovery.

Owing to stellar past performance, Pete is given sole responsibility for managing a new fund, starting with a hefty €100m of cash. His new challenge is to pick cheap US stocks in the current environment and invest wisely. Luckily, his new firm is equipped with Sismo, the quantamental assistant he’s been longing for.

To assess the valuation of companies, Pete uses various trading multiples, such as:

- P/B : Price to Book

- P/E : Price to Earnings (based on current, past or forecasted earnings)

- EV/Ebitda: Enterprise Value to Ebitda (based on current, past or forecasted Ebitda)

With Sismo comparative analysis charts, Pete can visualize at once such multiples (and many more indicators – see appendix) for all stocks in his investment universe, such as the Stoxx 600 or the Russell 1000. See this post for example.

But what if Pete wanted to have a synthetic view of each company’s relative valuation by combining all these indicators into a single one? That is precisely where Factors come into play.

Why Factors?

A precise description of Factors in Sismo is detailed in this post but the fast reader should keep in mind that a Factor is a composite indicator, ranging between -3 and +3, giving a synthetic view of multiple indicators, all at once.

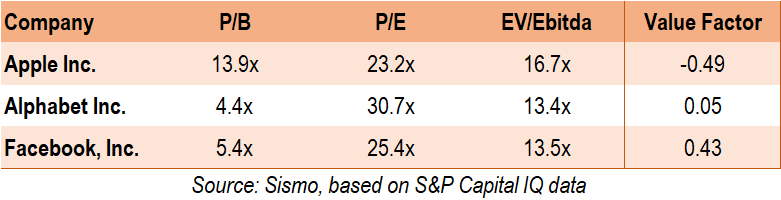

In the stylized example below, the review of individual indicators is inconclusive as to the relative valuation of these stocks. However, based on the Value Factor, Facebook is the cheapest stock (highest Value), Apple the most expensive (lowest Value), while Alphabet stands in the middle.

Creating Factors in Sismo

Each of the nearly 80 indicators (see Appendix) available in Sismo can be used as a component to a Factor. Each indicator can be individually weighted when defining the Factor. Pete goes on and creates his own Value Factor, with the Sismo Factor builder:

As an experience portfolio manager, Pete is concerned by the so-called Value trap: some companies might appear artificially cheap simply because of dismal recent price action (the numerator of valuation multiples) while estimates (the denominator) have not yet been adjusted by sell-side analysts. Value trap is just another word for catching the falling knife.

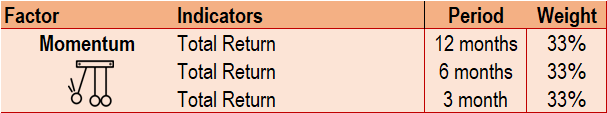

One way to protect against Value traps (as advocated by Prof. R. Shiller) is to exclude stocks with the worst recent price action (Momentum) measured over various time horizons. Pete creates his own Momentum Factor with the following time windows:

Screening for Value stocks with Sismo

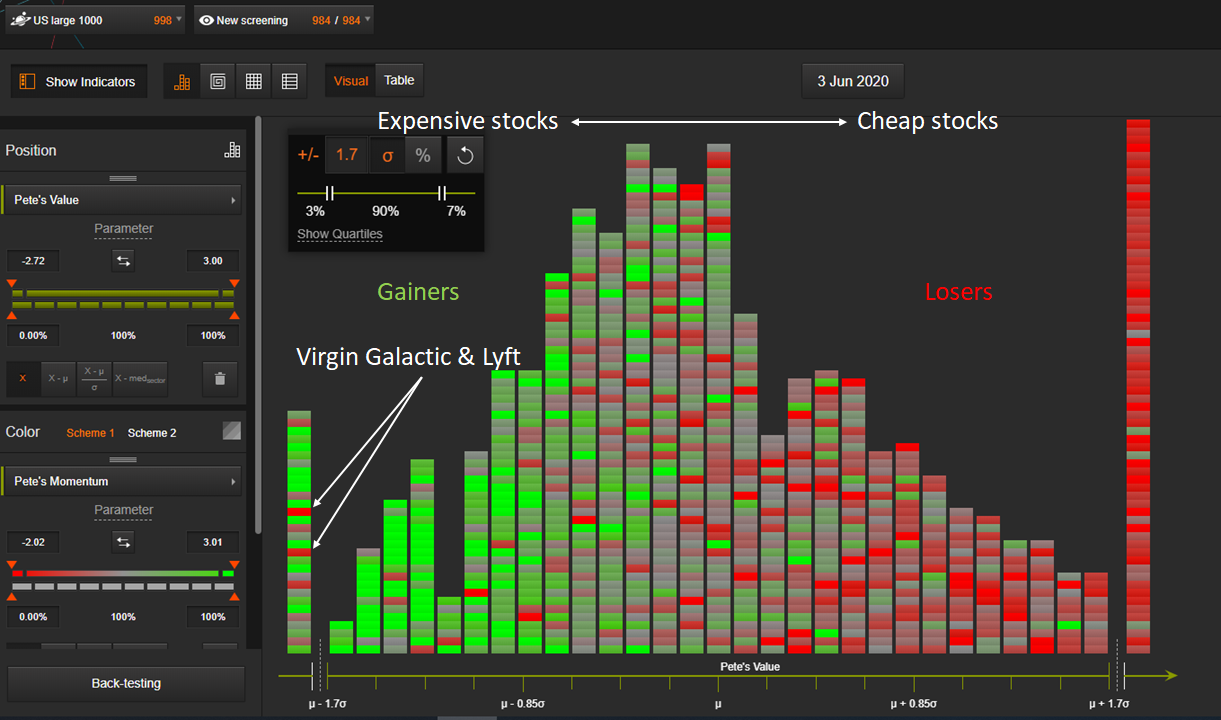

Factors created and calculated on Pete’s relevant universe (Russell 1000) can be visualized in Sismo:

All 1000 stocks in the Russell 1000 Index are distributed along the x-axis from min (left) to max (right) per their Valuation at 3 June 2020 (positive on the right side for cheap stocks, negative on the left side for expensive stocks). Stocks are colored per their market Momentum exposure at 3 June, from worst (negative) in dark red to best (positive) in flashy green. Unsurprisingly, both metrics show very strong anti-correlation: stocks with negative performance (Momentum) now appear cheap from a Valuation perspective (i.e. on the right side of the distribution). Some notable exceptions of stocks with bad Momentum but still very expensive (stocks on the left, colored in dark red): Virgin Galactic and Lyft.

Exposures of the 1000 largest stocks to Value (left to right) and Momentum (red to green) Factors

As of 3rd June 2020

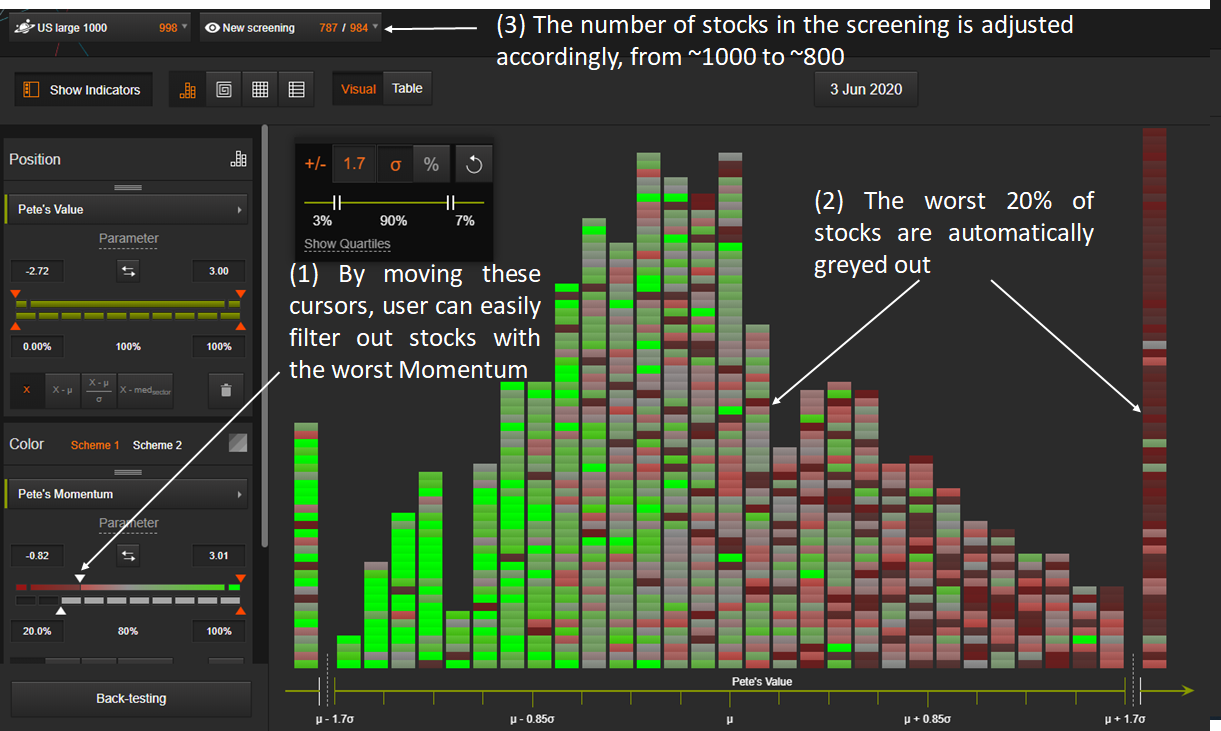

As Pete worries about the Value trap, he decides to filter out the 20% stocks with the worst performance. To this aim, he uses the filtering capacities of Sismo:

Exposures of the 1000 largest stocks to Value (left to right) and Momentum (red to green) Factors

Exclusion of the 20% stocks with the worst Momentum – As of 3rd June 2020

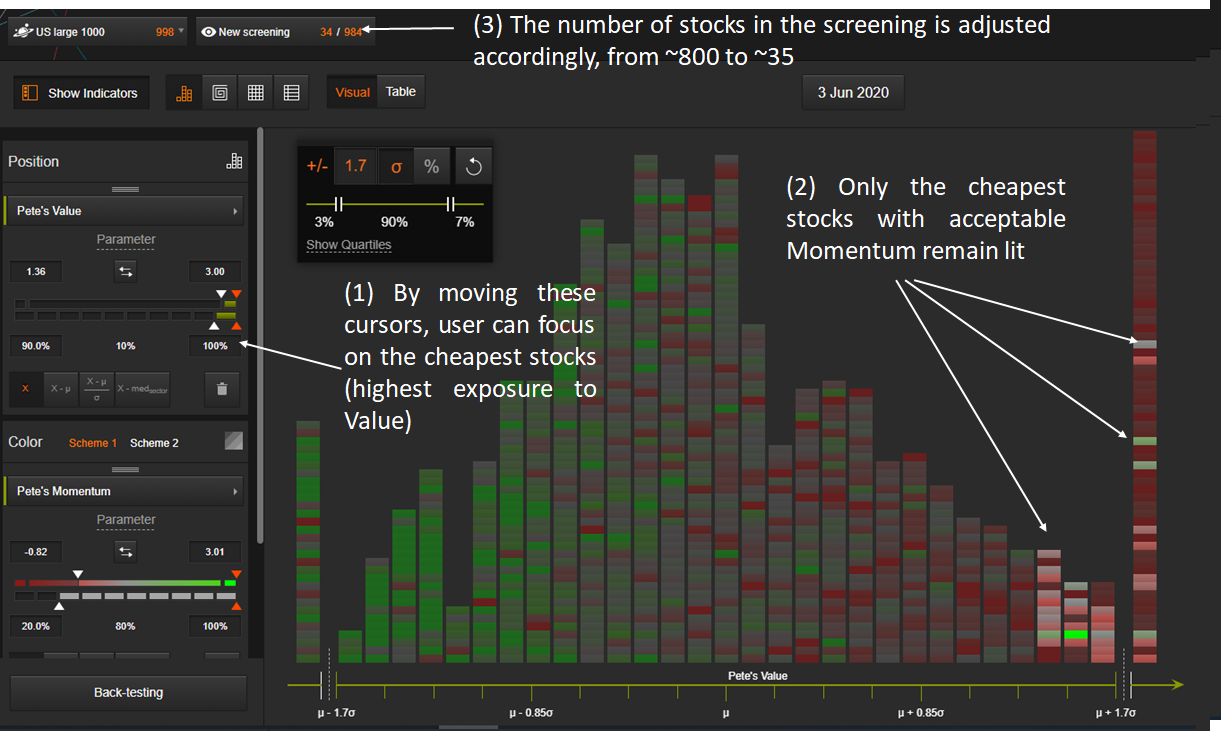

Now Pete filters the universe by the Value Factor to focus on the cheap stocks on the right hand side of the distribution.

Exposures of the 1000 largest stocks to Value (left to right) and Momentum (red to green) Factors

Filtering by Momentum and Value – As of 3rd June 2020

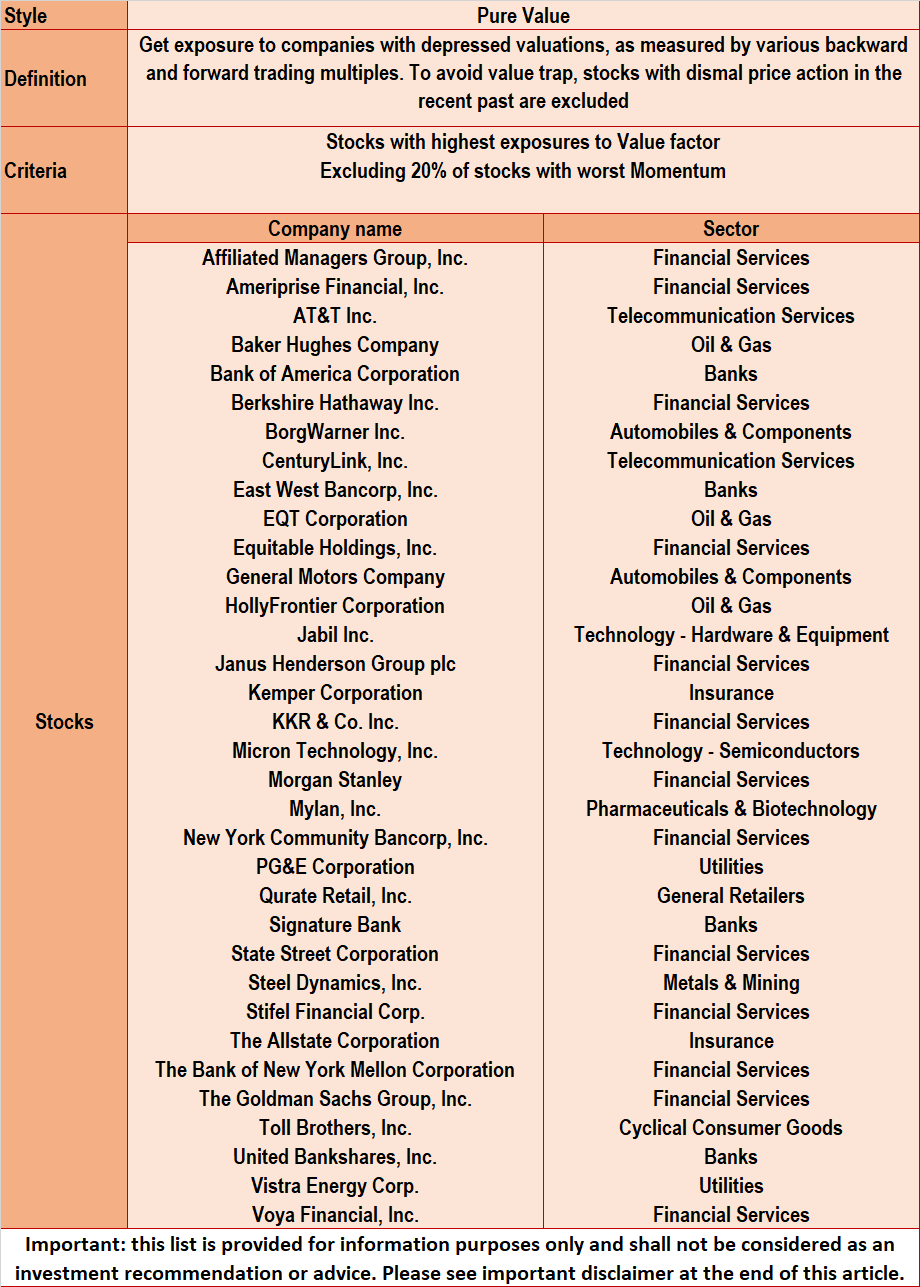

Pete can easily adjust this list of stocks by taking out or adding certain stocks. Once he’s satisfied with the result, he can save a “basket” list of such stocks for further analysis in Sismo or export it to Excel to share with his dealing desk. For information, the list of the 34 stocks is provided below.

Conclusion

This article was centered around the simplified case of a Value manager but any portfolio manager can use the depth of indicators in Sismo to create his own custom factors and filters to efficiently screen the market for opportunities relevant to her/his investment style. While the screening functionalities are very relevant for a PM starting from a blank page, Sismo also offers the possibility to visualize the existing portfolio through the factor lens (for example in this post), spot outliers and find similar stocks using the Sismo peer search (for example in this post).

In future articles, we will provide similar use cases for other investment styles (Growth, GARP…) and investment universe (Europe).

If this note sparked some interest and made you think, we would love to hear your comments at contact@sismo.fr.

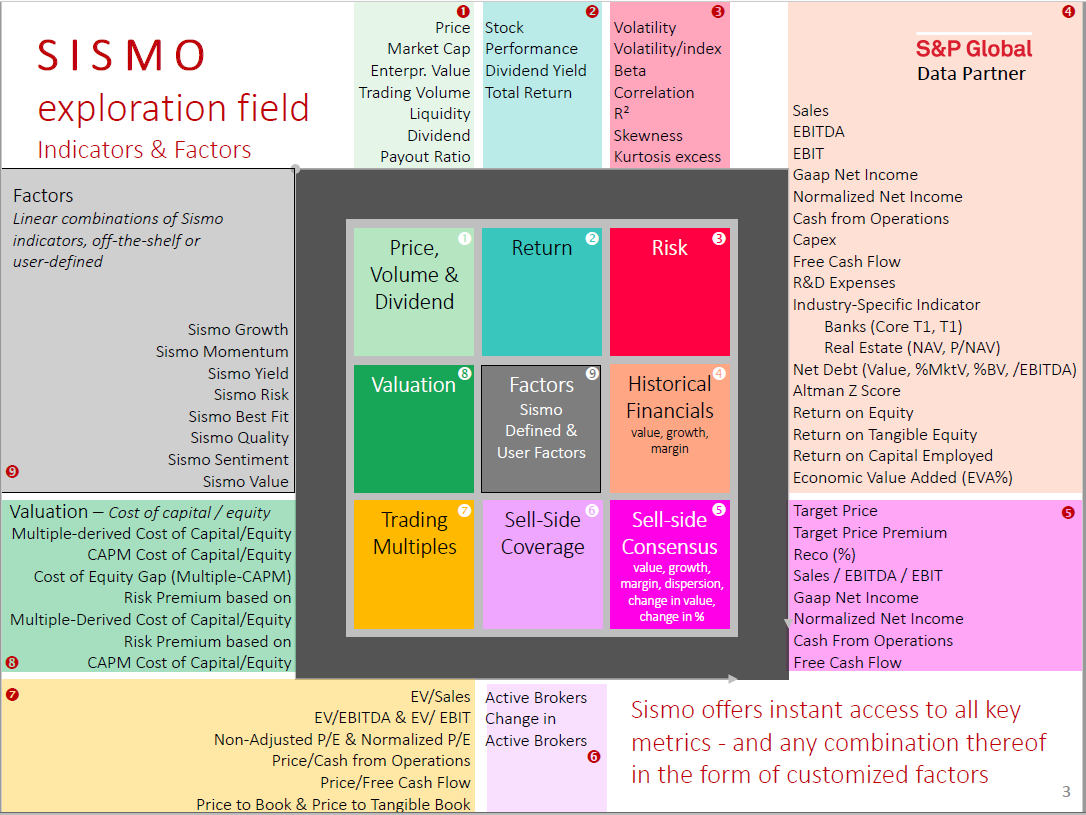

Appendix – list of available indicators

About Sismo

This study on the US equity market illustrates the analysis and visualization capabilities of Sismo, a visual analytics platform with direct web-access designed for discretionary equity portfolio managers that is integrated with European and US equity coverage from S&P.

Sismo combines innovative visualizations with advanced user interactions to facilitate the reading and understanding of market dynamics, select stocks, define and test investment strategies. It offers innovative screening and back-testing functionalities as well as investment style recognition and marginal portfolio optimization, leveraging on visual analysis capabilities to improve professionals’ investment decisions. Please visit www.sismo.fr.

Disclaimer

Past performances are not indicative of future performances. The information in this article is provided for information only and does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell, or otherwise transact in any investment including any products or services or an invitation, offer or solicitation to engage in any investment activity.

3,172 total views, 8 views today